How to Make More Money in Less Time After Retirement

Discover smart ways to earn extra income post-retirement while working fewer hours. Learn about flexible jobs, passive income, and financial strategies to enjoy life while making money.

Making More Money in Less Time Post Retirement

Table of Contents:

Introduction: Why Earn Money After Retirement?

Leverage Your Experience with Flexible Work

○ Consulting or Freelancing

○ Teaching and Mentoring

Create Passive Income Streams

○ Real Estate Investments

○ Dividend Stocks

○ Digital Products

Start a Low-Maintenance Business

Explore the Gig Economy

Monetize Your Hobbies

FAQs

1. Introduction: Why Earn Money After Retirement?

While retirement was traditionally seen as a time to stop working altogether, many retirees are now choosing to stay engaged by earning extra income. Whether it’s to maintain financial security, pursue personal passions, or simply stay active, making more money post-retirement can improve both your lifestyle and well-being. The key is finding opportunities that allow you to earn more while working fewer hours.

2. Leverage Your Experience with Flexible Work

Consulting or Freelancing

If you have decades of professional experience, consulting can be a lucrative post-retirement job. Companies often seek industry veterans for advice and strategy, making this a high-income opportunity with flexible hours.

Popular Consulting Areas:

● Business management

● Financial planning

● Marketing and public relations

Pro Tip: Use platforms like LinkedIn or Upwork to connect with potential clients.

Teaching and Mentoring

Sharing your knowledge through teaching or mentoring can be highly rewarding. You can teach at local community colleges, offer private tutoring, or even create online courses on platforms like Udemy or Teachable.

Pro Tip: If you prefer mentoring over formal teaching, join industry-specific mentorship programs or offer career coaching services.

3. Create Passive Income Streams

Passive income allows you to earn money with minimal ongoing effort. While these opportunities may require some initial investment or setup, they can generate income consistently over time.

Real Estate Investments

Investing in rental properties can provide regular cash flow with minimal day-to-day involvement. If managing tenants feels overwhelming, consider investing in Real Estate Investment Trusts (REITs) for a hands-off approach.

Pro Tip: Hire a property manager to handle daily operations, freeing up your time while still earning passive income.

Dividend Stocks

Dividend-paying stocks are a great way to earn passive income post-retirement. Invest in companies with a strong history of paying consistent dividends to generate a steady cash flow.

Pro Tip: Reinvest dividends during your early retirement years to maximize compounding returns.

Digital Products

If you have expertise in a specific field, consider creating digital products such as e-books, online courses, or printable templates. Once created, these products can be sold repeatedly with little to no additional effort.

Pro Tip: Use platforms like Gumroad or Amazon Kindle Direct Publishing (KDP) to market and sell your digital products.

4. Start a Low-Maintenance Business

Starting a low-maintenance business allows you to be your own boss without committing to full-time work. Some ideas include:

● Dropshipping: Set up an online store without managing inventory.

● Rental Services: Rent out your car, tools, or vacation home.

● Pet Sitting or House Sitting: These services are in high demand and offer flexibility.

Pro Tip: Focus on businesses that align with your interests to make the work enjoyable.

5. Explore the Gig Economy

The gig economy offers countless opportunities to earn money on your schedule. Popular gig options include:

● Ridesharing and Delivery: Apps like Uber, Lyft, and DoorDash allow you to work whenever you want.

● Online Microtasks: Websites like Amazon Mechanical Turk or Fiverr offer tasks you can complete from home.

● Virtual Assistance: Help businesses with tasks like scheduling, email management, and social media from the comfort of your home.

Pro Tip: Choose gigs that fit your lifestyle and don't require long-term commitments.

6. Monetize Your Hobbies

Turning your hobbies into income streams is a fun and fulfilling way to make money post-retirement. Here are a few ideas:

● Photography: Sell your photos to stock image websites or offer freelance photography services.

● Crafting: Create and sell handmade items on platforms like Etsy.

● Writing: Start a blog, write a book, or offer freelance writing services.

Pro Tip: Focus on hobbies you genuinely enjoy, so earning money feels more like a bonus than a job.

7. FAQs

Q1. How much time should I spend working after retirement?

It depends on your personal goals and lifestyle. Many retirees find that working 10-20 hours a week is ideal for staying engaged without compromising their newfound freedom.

Q2. What are the best passive income options for retirees?

The best passive income options include dividend stocks, rental properties, and creating digital products. These require upfront effort but generate ongoing revenue with minimal maintenance.

Q3. Can I start a business after retiring?

Yes, starting a business after retirement is a great way to stay active and earn extra income. Focus on low-maintenance businesses or those that align with your passions.

Q4. Is working post-retirement necessary?

It’s not necessary for everyone, but it can provide financial security, a sense of purpose, and opportunities to stay socially connected.

Thanks for taking the time to read Wealth Blueprint.

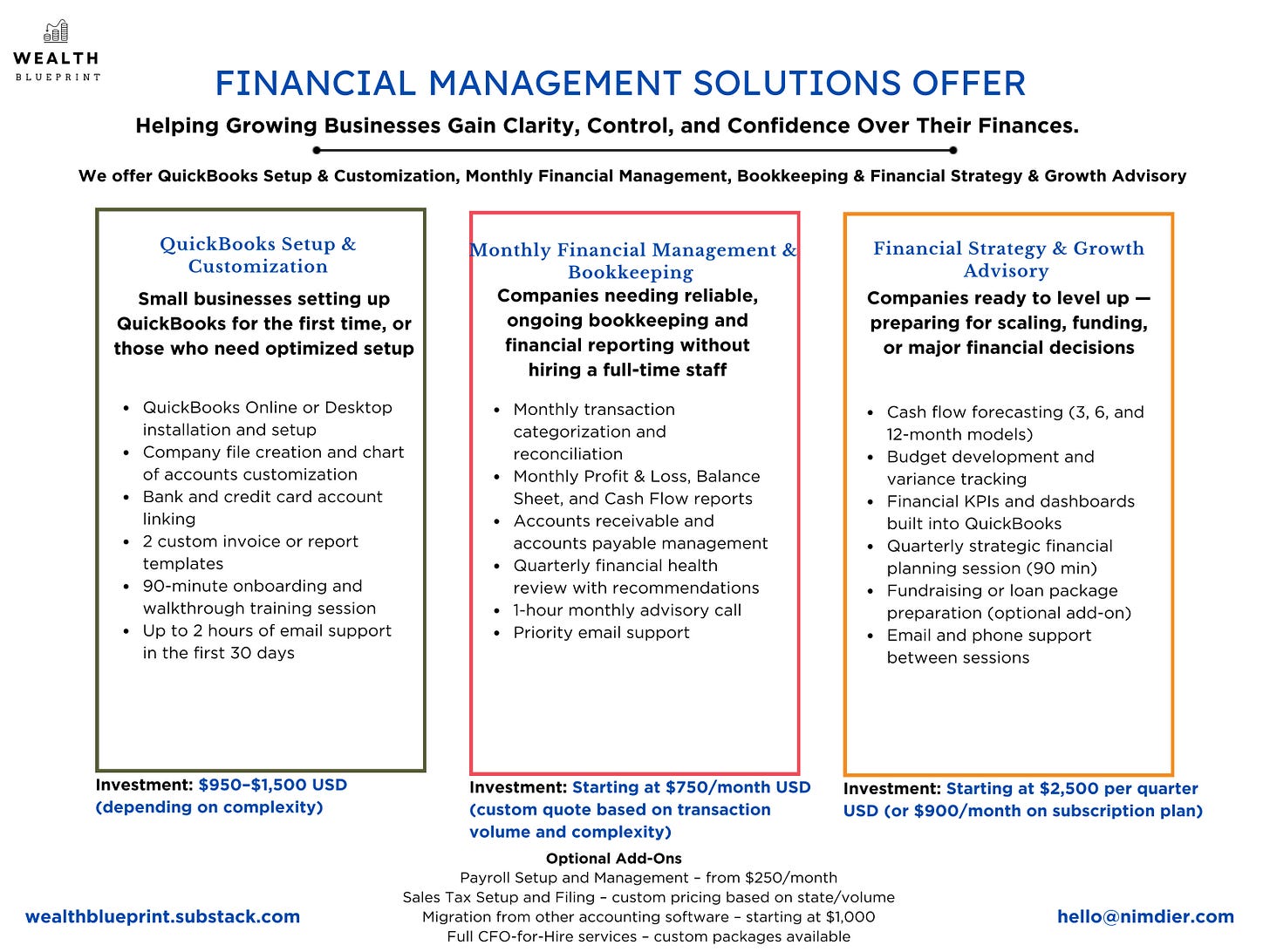

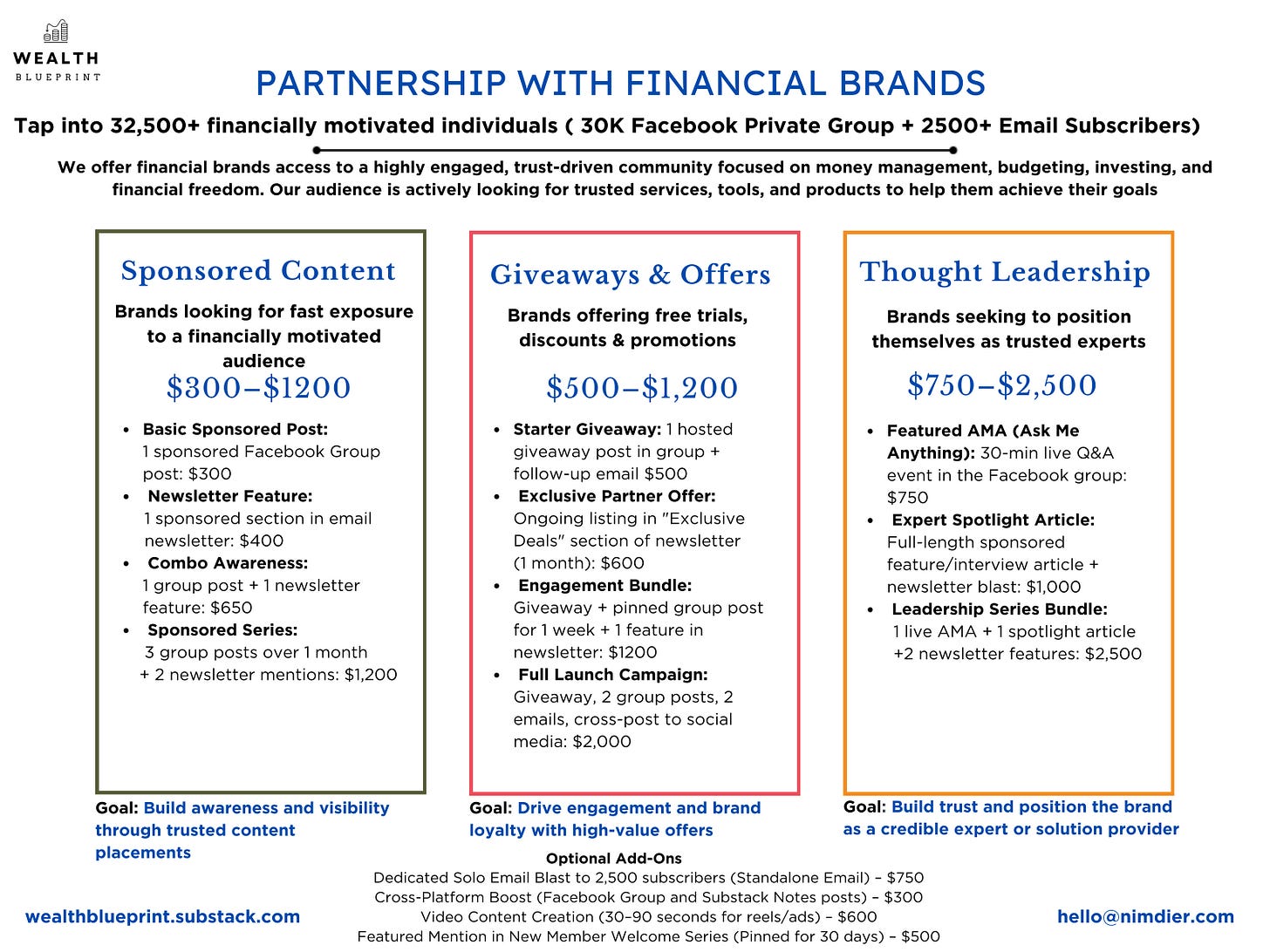

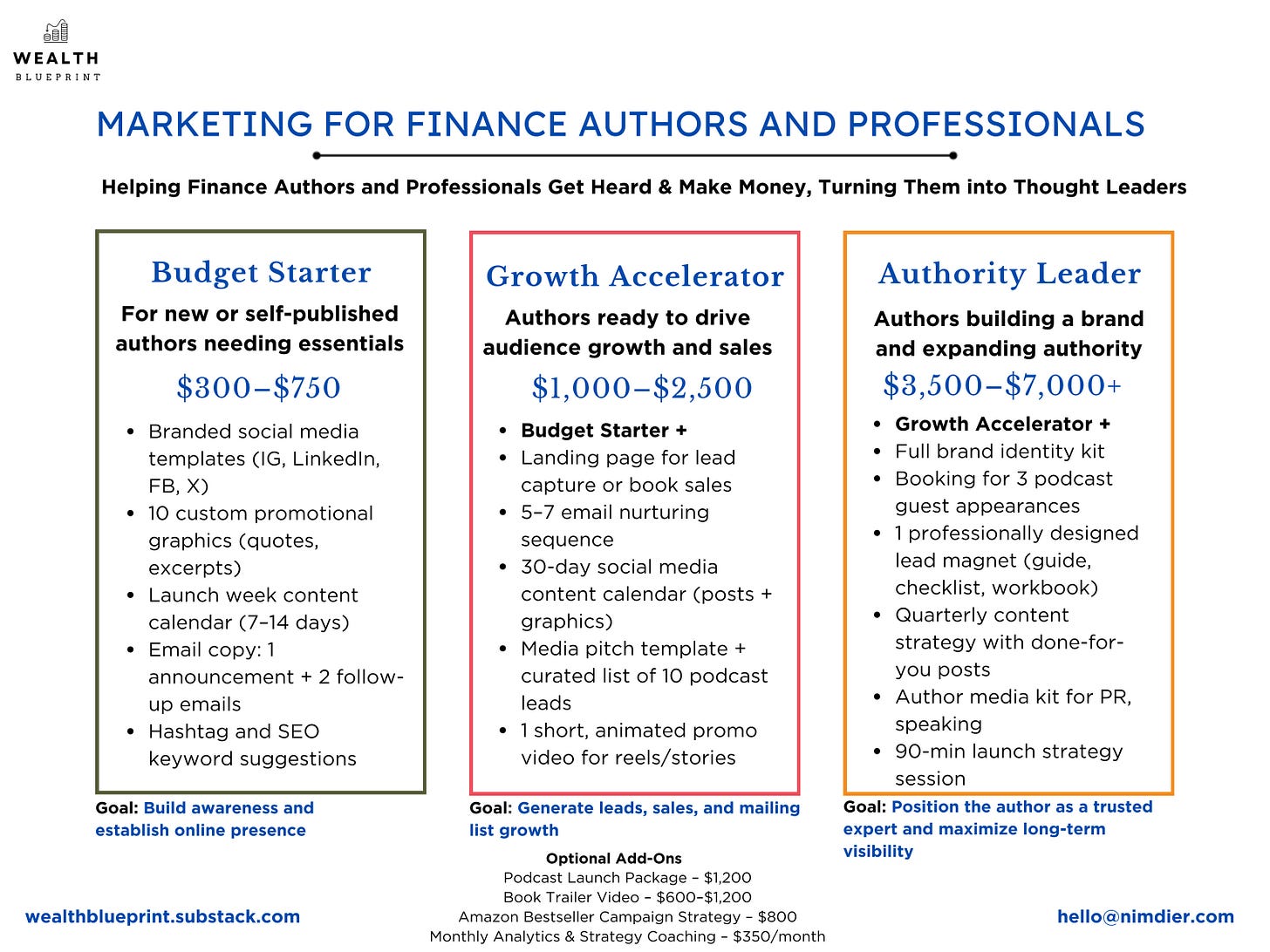

P.S. When you're ready, here are three ways we can help you manage your finances as a small or mid-size business. We also work with financial service brands and finance authors or professionals looking to grow their brands.

Contact us at: hello@nimdier.com

OUR SERVICES